The Option element simulates the acquisition and exercise of financial options (puts and calls). You specify the type of option, option properties (e.g., number of units, strike price, term), the unit value of the underlying stock, and when the option is acquired and exercised, and the element outputs the value realized upon exercise of the option.

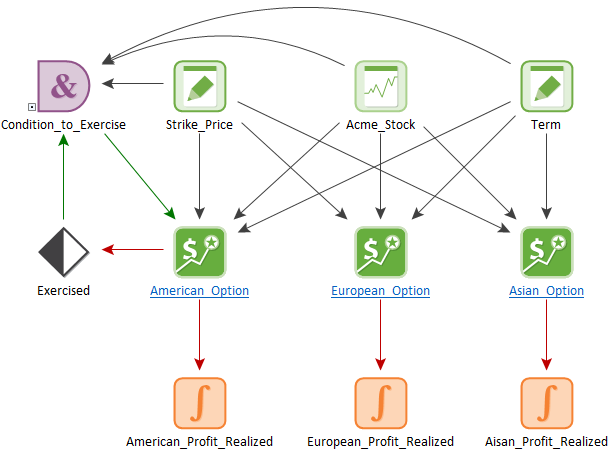

The Option.gsm example model can be found in the can be found in the Financial Examples folder in your GoldSim directory (accessed by selecting File | Open Example... from the main menu). It demonstrates how an Option element can be used to model American, European and Asian calls on an underlying stock:

In the model, a History Generator An element that generates stochastic time histories of variables. A stochastic time history is a random time history that is generated according to a specified set of statistics. element is used to model the price movement of the underlying stock, which is the input into three different Option elements.

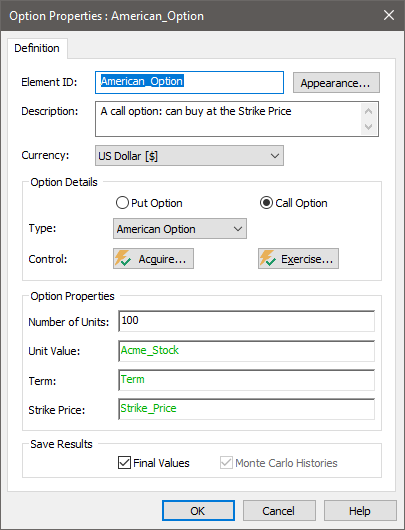

The strike price, option type, term, and conditions for exercise prior to expiry (for American options) are all specified in the option element:

If the condition for exercise occurs, or the value of the option is greater than zero at the end of the option's term, the option is exercised and a discrete change representing profit from the option is placed in the Profit_Realized element.

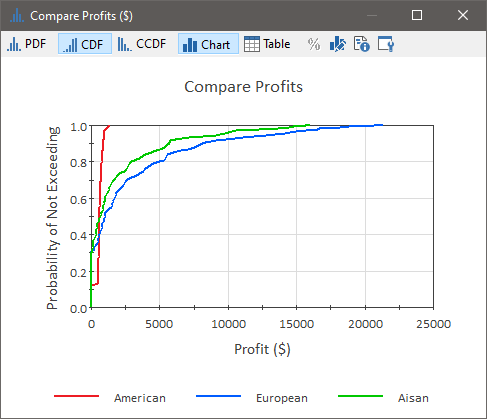

Given the stochastic nature of the underlying stock (as modeled by the History Generator), multiple Monte Carlo realizations are carried out. The primary output For an element with multiple outputs, the output that has the same name as the element. of the model is a Distribution Result comparing the profits of the three different types of options:

Learn more

- Example: Comparing Alternatives Using a Cash Flow Element - Repair vs. Replace

- Example: Simulating a Loan Using a Fund Element

- Example: Simulating a Reinsurance Policy

- Example: Simulating a Stock Portfolio

- Example: Simulating Long and Short Positions on a Security

- Example: Simulating Variable Exchange Rates

- Example: Using the Cash Flow Element

- Example: Using the Fund Element

- Example: Using the Insurance Element

- Example: Using the Investment Element

- Example: Using the Option Element