Once an option is acquired, its value is computed by GoldSim as follows:

- For Put options:

Option Value = (Strike Price - Unit Value)*Number of Units - For Call options:

Option Value = (Unit Value - Strike Price)*Number of Units

In both cases, if the Option Value evaluates to a negative number, it is set to zero. Options with positive Option Values are said to be in the money. Hence, Put options are in the money if the Strike Price is greater than the current Unit Price. Call options are in the money if the Strike Price is less than the current Unit Price.

Note: When valuing an option, GoldSim does not account for the price that you paid to purchase the option. It only accounts for the value of the option at the time it is exercised.

It is important to note that when computing the Option Value, GoldSim uses the values for the Strike Price and the Number of Units that existed at the time the Option was acquired, while it uses the Unit Value that exists at the current time (i.e., whenever the Option Value is computed).

After you acquire an Option, it can be exercised in one of two ways:

- For all option types, the Option is automatically exercised at its time of expiration if it is in the money.

- For American

options, the Option can be exercised any time after acquisition via the

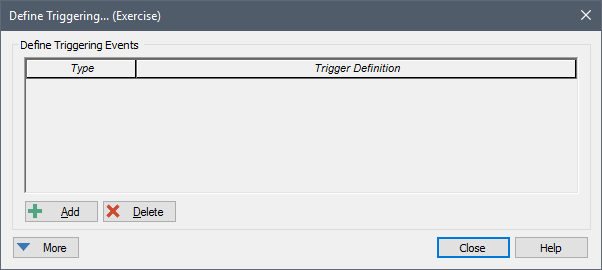

Exercise... button. Pressing this button brings up

the standard GoldSim triggering dialog:

This dialog allows you to specify conditions or events that will result in an exercise to be triggered.

Warning: If you exercise an American option An option that may be exercised at any time prior to the expiration date. (via the Exercise... trigger) that is not in the money (has a value of zero), GoldSim will immediately cancel the Option.

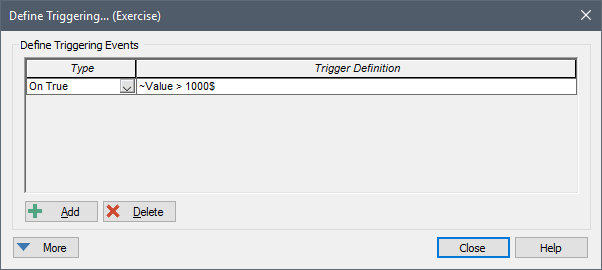

Under some circumstances, you may want to define the trigger in terms of the current value of the options (e.g., "exercise the option if the value exceeds X") GoldSim facilitates this by providing a locally available property called "Value". This represents the current value of the option (as defined above). You would reference this value as "~Value":

Note: Value is an example of a locally available property. As such, it only has meaning inside the Trigger Definition field, and cannot be referenced anywhere else.