Element

Default Symbol

Function

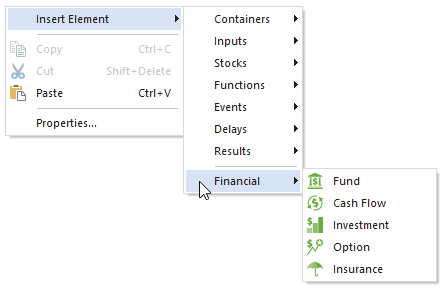

Fund

Simulates funds and accounts with specified deposits, withdrawals, and interest rates. Outputs include the fund balance and the cumulative interest paid.

Cash Flow

Computes the net present value (NPV) and internal rate of return (IRR) of a cash flow history. Used to model the future return of projects, business ventures, and similar undertakings.

Investment

Simulates an investment such as a security or portfolio of securities. Inputs include purchases and sales, and a history of the underlying security's unit value. Primary output is the investment's value.

Option

Simulates the acquisition and exercise of financial options (puts and calls). Inputs include option type (American, European, Asian), terms and strike price, as well as triggers for acquiring and exercising the option. Primary output is current value (if exercised).

Insurance

Simulates claims against an insurance policy. Inputs include the deductible and cap for the policy, as well as the claims. Outputs include the cumulative covered and uncovered losses on the claims.

Note: In order to make the

Financial Module elements available, you must activate the module.

Note: In order to make the

Financial Module elements available, you must activate the module.