The Option element simulates the acquisition and exercise of financial options (puts and calls).

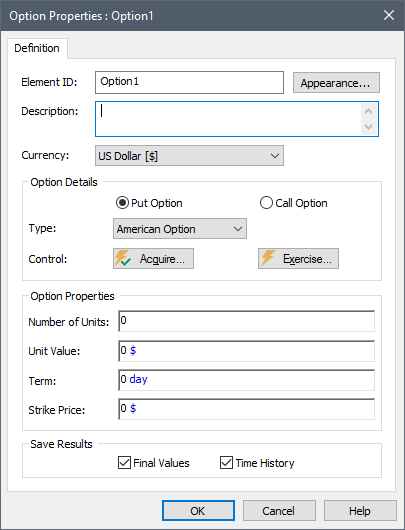

The property dialog looks like this:

After specifying the currency units you wish to use, you must specify whether you are simulating a put or a call, along with the option type (American European, Asian).

The unit value of the underlying security must also be specified. This can be any function, but will often be the output of a History Generator An element that generates stochastic time histories of variables. A stochastic time history is a random time history that is generated according to a specified set of statistics. element. This element (which is part of the basic GoldSim framework), provides a variety of alternatives for generating time histories, including simply specifying a constant annual growth rate, and specifying a stochastic growth rate (defined using a mean annual growth rate and volatility, and simulated as a Wiener process)

Triggers must be specified for acquiring and exercising the option. You must also specify the properties of the option at the time of acquisition (i.e., number of units, term and strike price).

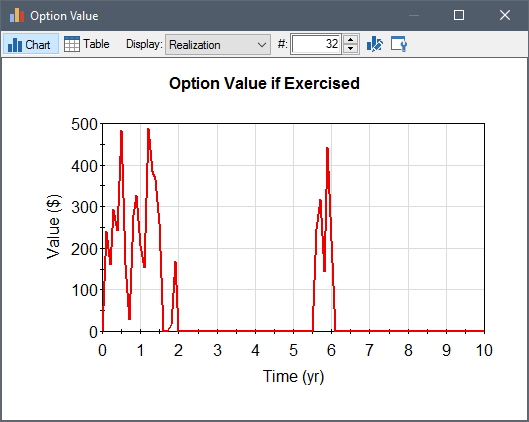

The primary output For an element with multiple outputs, the output that has the same name as the element. is current value (if exercised), and a discrete change signal A discrete signal that contains information regarding the response to an event. with the value of the exercised options: