The Cash Flow element computes the

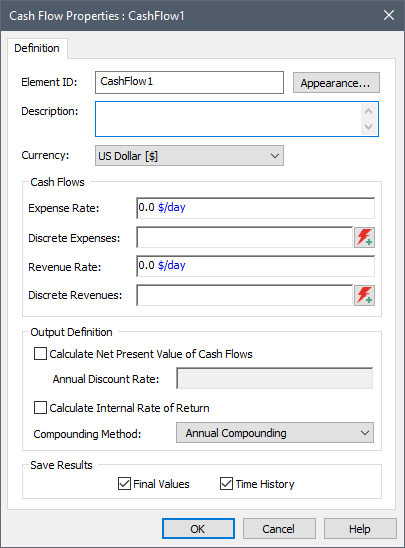

The property dialog looks like this:

After specifying the currency units you wish to use, you must specify expenses and revenues (which can be entered as continuous rates or discrete items).

You then specify whether you want to compute the NPV, the IRR (or both). Calculation of the NPV requires a discount rate.

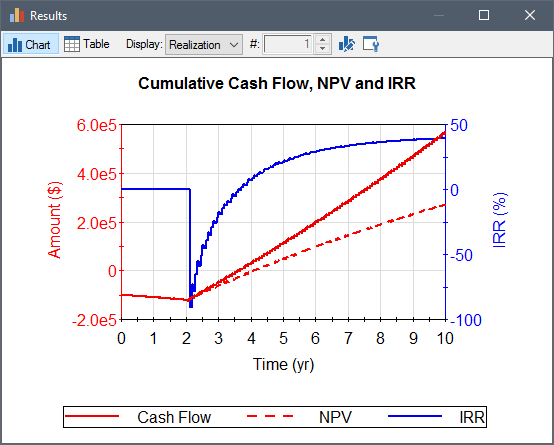

In addition to the NPV and the IRR, the element also outputs the cumulative (undiscounted) cash flow (revenues -expenses):