Before creating stochastic time histories using the History Generator element, it is instructive to briefly summarize the different kinds of time histories that can be generated.

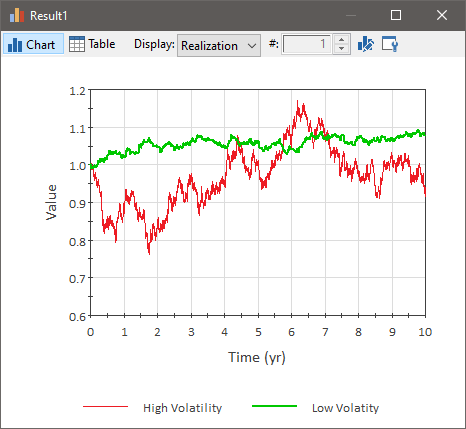

Consider the stochastic time histories below:

These are random histories that follow no particular trend. They simply randomly walk through time. Clearly one of the curves has larger random fluctuations than the other. For certain types of variables (e.g., stock prices), the variability of the time history as a function of time is described in terms of a volatility. The history with greater fluctuations is said to be more "volatile".

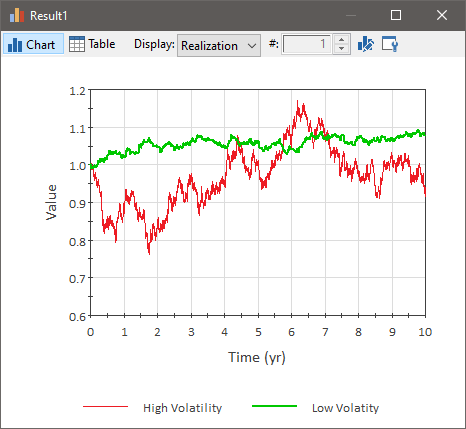

Note that the volatility is often a function of the unit of time on which it is based. In the examples shown above, the volatility increases with time (i.e., the annual volatility is greater than the daily volatility). For other types of stochastic variables, however, the volatility may stay constant with time. In the example below, the variable represented by the upper curve is target-reverting. That is, the value reverts to some underlying target (in this case, a constant value of 1). As a result, the volatility is constant in time.

The histories in the two examples above either move randomly through time, or move randomly around some constant target. Other stochastic histories may follow a trend.

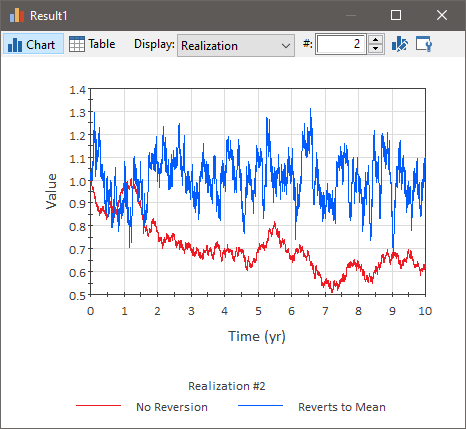

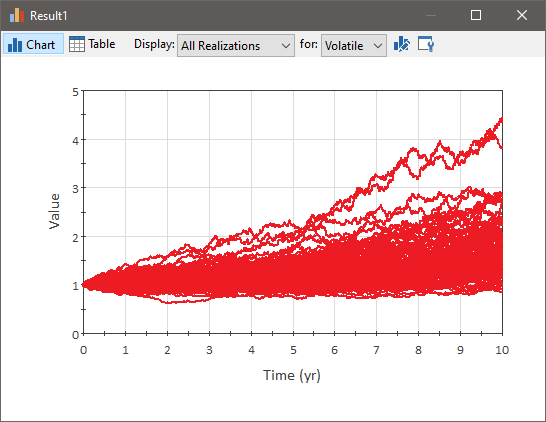

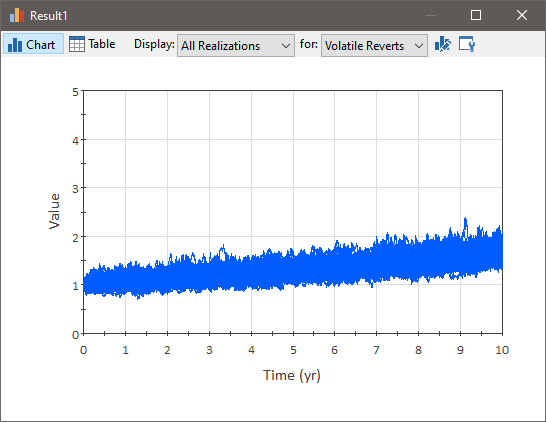

The histories below grow geometrically at a rate of 5% per year (this is referred to as geometric Brownian motion):

The dark smooth line is growth with no volatility. The other two lines both are volatile. In one, the volatility grows with time. In the other, the volatility stays constant.

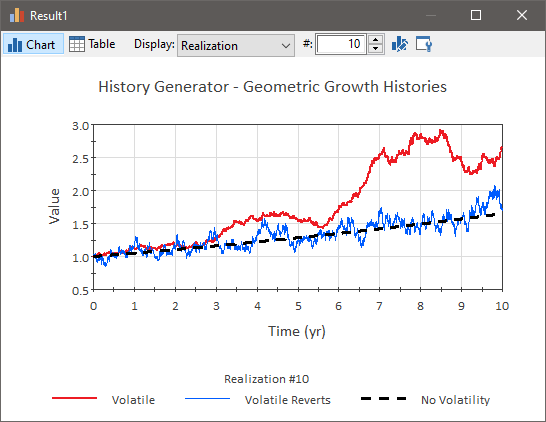

If we were to run multiple realizations of the time history whose volatility grows with time, the growth in the volatility as a function of time would be more noticeable:

Compare this to multiple realizations of the time history whose volatility stays constant with time:

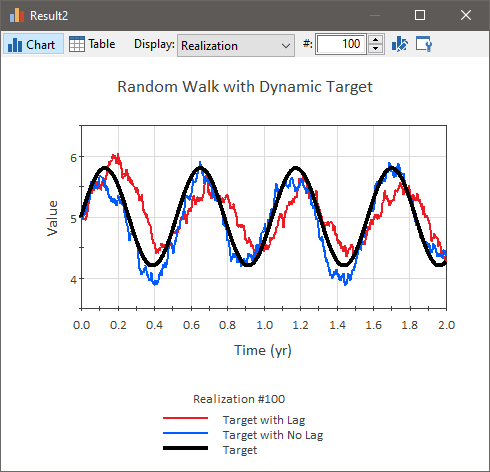

Of course, the underlying trend does not need to be growth (positive or negative). The histories below follow a cyclical trend:

The dark smooth line is the signal with no volatility. The other two lines are both volatile. In one, the history lags the underlying trend. In the other, there is no lag.

The History Generator element can be used to generate all of these types of stochastic time histories.