The last five financial functions are used to convert between different types of financial return statistics.

In order to understand these functions, it is first necessary to provide some definitions.

Consider a time series (e.g., of the price of a stock): Pt, Pt+1, Pt+2,…, where Px is the price at year x. The annual return can be defined in several different ways, the most common of which are:

The annual return (Rx) between year x and year x+1 is defined as:

Rx = (Px+1 – Px)/Px.

The log annual return (LRx) between year x and year x+1 is defined as:

LRx = ln(Px+1/Px)

The log annual return is equivalent to the continuously-compounded rate.

Given multiple years of data, these two annual return definitions represent time series of data. Mean annual returns of such a series can be defined in multiple ways:

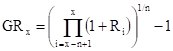

The geometric mean annual return (GRx) at time x given a series of n annual returns from year x-n to x is defined as:

The arithmetic mean annual return (ARx) at time x given a series of n annual returns from year x-n to x is defined as:

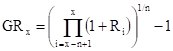

The arithmetic mean log annual return (ALRx) at time x given a series of n annual returns from year x-n to x is defined as:

The arithmetic mean log annual return is equivalent to the mean continuously-compounded rate.

The geometric mean annual return is the most common statistic used to describe mean annual returns. Hence, when the multiyear return for a mutual fund or stock is quoted, this is typically a geometric mean annual return

In addition to mean returns, the standard deviation of the series of returns can also be computed:

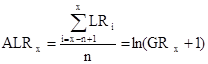

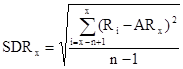

The standard deviation of the annual return (SDRx) at time x given a series of n annual returns from year x-n to x is defined as:

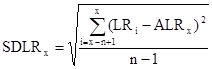

The standard deviation of the log annual return (SDLRx) at time x given a series of n annual returns from year x-n to x is defined as:

The standard deviation of the log annual return is also referred to as the volatility.

The last five financial functions are used to convert between the statistics describing financial time series:

|

Function |

Description |

|

gm2cm(geo. mean) |

Converts a geometric mean annual return (GR) to a mean continuously-compounded rate – i.e., an arithmetic mean log annual return (ALR). |

|

cm2gm(cont. mean) |

Converts a mean continuously compounded rate – i.e., an arithmetic mean log annual return (ALR) to a geometric mean of the annual return (GR). |

|

ari2cm(mean, SD) |

Converts an arithmetic mean annual return (AR) and a standard deviation of the annual return (SDR) to an arithmetic mean log annual return (ALR). |

|

ari2vol(mean, SD) |

Converts an arithmetic mean annual return (AR) and a standard deviation of the annual return (SDR) to the standard deviation of the log annual return (SDLR), also known as the volatility. |

|

geo2vol(geo. mean, SD) |

Converts a geometric mean annual return (GR) and a standard deviation of the annual return (SDR) to the standard deviation of the log annual return (SDLR), also known as the volatility. |

geo. mean, cont. mean, mean (GR, ALR, AR): Must be greater than zero. SD (SDLR): Must be greater than or equal to zero. Arguments can be scalars or arrays.