The next two financial functions are used to convert a continuously compounded interest rate to an equivalent periodically compounded interest rate, and vice-versa.

In these functions the first argument (either ann. rate or cont. rate) is the fractional interest rate (expressed as either a fraction or a percentage), and the second argument (#/yr) is the number of times the equivalent periodically compounded rate is compounded per year:

| Function | Description | Definition |

| pc2cc(ann. rate, #/yr) | Converts an annual interest rate (ann.rate) that is compounded #/yr per year to an equivalent continuously compounded interest rate. |

|

| cc2pc(cont. rate, #/yr) | Converts a continuously compounded interest rate (cont.rate) to an equivalent periodically compounded annual rate that is compounded #/yr per year. |

|

cont. rate (Crate): Must be greater than or equal to zero. Can be a scalar or an array

#/yr (n): Must be a positive scalar.

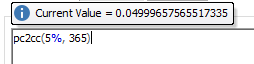

For example, the following expression computes the continuously compounded interest rate that is equivalent to an annual interest rate of 5%, compounded daily: